Markets at All-Time Highs - What Comes Next?

Lately, U.S. stock markets have been on a strong run. The S&P 500, Nasdaq, and Dow have all hit new all-time highs. For investors, that can bring a mix of excitement — and maybe a little anxiety. So what does it really mean when markets reach these milestones?

Market Highs Are Normal

Despite how dramatic the headlines can sound, all-time highs are nothing unusual. They’re a natural part of a long-term upward trend. In fact, the S&P 500 has hit hundreds of new highs over the decades. Markets don’t stop moving just because they’ve reached a record — they often keep climbing.

A recent chart from JPMorgan shows that market highs tend to cluster — meaning new highs often lead to more highs. Statistically, the 12-month return after a high has often been positive. That’s not to say a pullback is impossible—corrections are a natural and healthy part of market cycles—but a high itself isn’t a reason to panic or predict doom.

What About Today?

Many unique factors play a role in the economy and markets, so every scenario is unique. We’ll look at two big topics shaping the current environment: valuations and interest rates.

Valuations Look Elevated

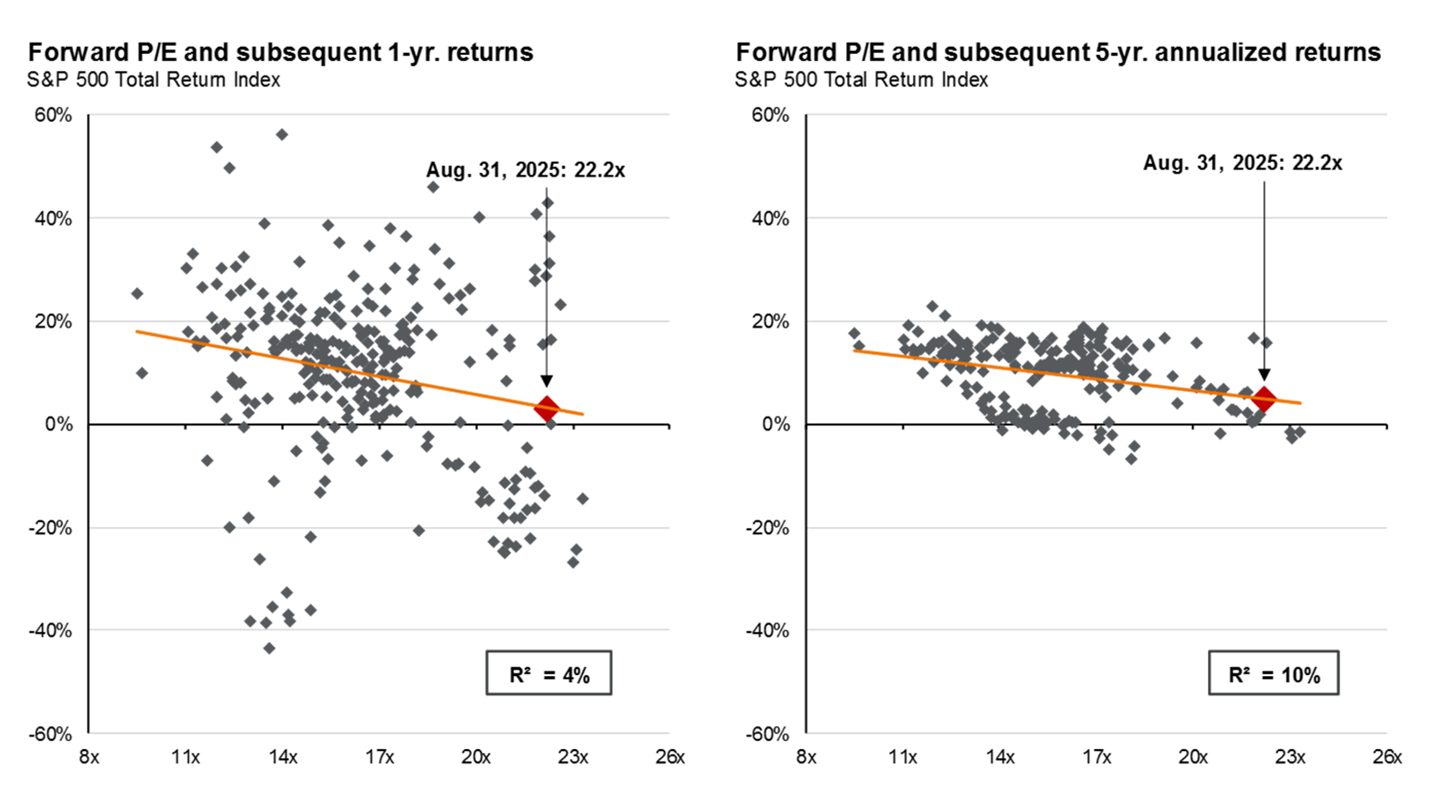

Fed Chair Jerome Powell recently said stock valuations look “high by historical standards.” And he’s not wrong — based on forward P/E ratios (price-to-earnings), stocks are above long-term averages.

But even when valuations are high, future returns have still been positive on average. The market doesn’t move based on one factor alone

Interest Rate Cuts Can Help

The Fed cut interest rates on September 17. Historically, when the Fed cuts rates near market highs, stocks have done well. According to LPL Financial, in 28 such instances since 1984, the market was up an average of 13% over the next year, with 93% of those cases showing gains.

Stick to the Plan

Timing the market consistently and correctly is virtually impossible, even for investment professionals.

Instead, the best approach is simple:

Stay focused on your long-term goals

Keep a diversified portfolio

Rebalance when needed

Whether markets are making headlines for highs or lows, a steady and disciplined approach tends to win over time. Highs are part of the journey — not a reason to change course.